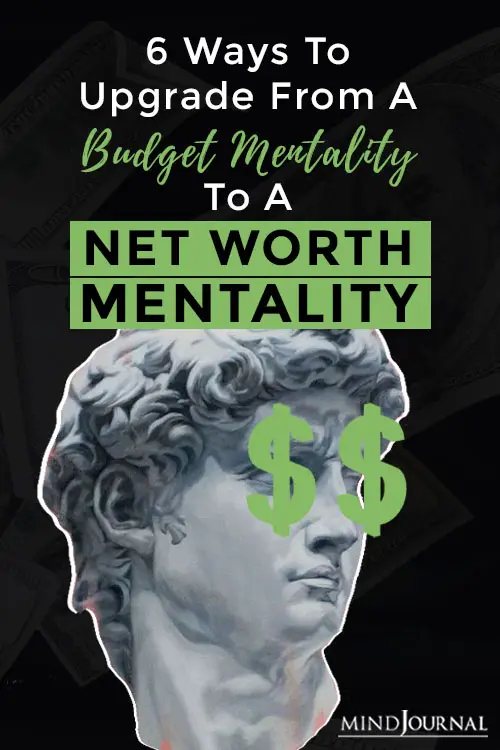

Are you struggling with your finances? Is the problem with your budget or with your mindset? Developing a net worth mentality can help you overcome typical middle-class beliefs and experience financial independence.

What Is The Net Worth Mentality

This mindset forces us to look at our personal finances from a long-term perspective. It not only encourages us to manage our finances beyond the month but shows us how we can increase our funds to experience complete financial independence.

The net worth mentality is a concept for financial success which is derived from the insightful book The Bogleheads’ Guide to Investing by Taylor Larimore, Mel Lindauer, Michael LeBoeuf, and a foreword by John C. Bogle. On page 7 of the paperback edition, the book explains this mindset as:

“From the time we are old enough to understand, society conditions us to confuse income with wealth. We believe that doctors, CEOs, professional athletes, and movie actors are rich because they earn high incomes. We judge the economic success of our friends, relatives, and colleagues at work by how much money they earn. Six- and seven-figure salaries are regarded as status symbols of wealth.

Although there is a definite relationship between income and wealth, they are very separate and distinct economic measures.”

It adds “Income is how much money you earn in a given period of time. If you earn a million in a year and spend it all, you add nothing to your wealth. You’re just living lavishly. Those who focus only on net income as a measure of economic success are ignoring the most important measuring stick of financial independence. It’s not how much you make, it’s how much you keep.”

The budget or paycheck mentality keeps us focused on growing our income as opposed to growing our net worth. One you realize the importance of saving money and become very intentional about your spending, you can finally start shifting your mindset to focusing on net worth.

This will not only enable you to earn more money but empower you to keep more money and build security and long-lasting assets to have a better life for you and your family. The key is understanding that income and wealth are separate ideas.

Read Can Saving Money Make You Happier?

Author and entrepreneur Trent Hamm explains “It’s not how much you make, it’s how much you keep. That’s a very strong assertion… The money you keep is the money that will allow you to be truly financially free. The one true path to a future where you can do whatever you want is to have a high net worth.” This is the reason why the rich get richer and how you can start thinking like a rich person.

Ways To Shift To Net Worth Mentality

If you want to develop a net worth mentality, then you need to start by changing how you look at money. Once you do that, you need to change your thoughts, attitudes, behaviors, and practices related to your personal finances. When you do this, you will be able to develop the right habits to help you shift from a budget mentality to a net worth mentality.

Brett and Kate McKay explain “Increasing your net worth is just a matter of paying off debt, saving more, and earning more. Simple in concept, but often hard to do. You really have to start playing the long game with your finances when you switch from a paycheck to a net worth mentality.”

Here are a few ways that can help you get started and boost your net worth:

1. Spend Less Than You Earn

If you want to increase your wealth, then you need to be more intentional about your spending. When you practice frugality, you add more value to your life. When you understand that it is not necessary for you to spend your entire paycheck in a month, you will realize that you can use the same paycheck as a tool to increase your wealth.

So every month you need to plan your personal finances in a way that you will still have money left in your bank after your monthly expenses, savings, and retirement planning. To do this, you might need to prioritize your expenditures and cut out unnecessary things.

“While you might not have much control over your income, you have significant control over how much you save. So maybe your boss can’t give you a raise this year – start saving more money by going out to eat less or buying fewer clothes,” add the McKays.

Read How To Be Extraordinary: Top 12 Traits of Successful People

2. Create An Emergency Fund

Instead of simply planning for the monthly budget, set long term financial goals that will help you to grow your wealth. One of the ways to develop a net worth mentality is to break your primary financial goal into micro-goals that can be managed more easily. And a great way to do this is to set up an emergency fund.

“An emergency fund is money for those unexpected setbacks in life and their accompanying bills,” writes Brett and Kate.

Your emergency fund can prove highly useful when there are sudden expenses you need to meet. Instead of using your credit card to pay for such unforeseen expenses and adding to your debt, you can just use this fund for emergencies. But the best part is, you will still be enjoying interest in your bank account, boosting your net worth.

3. Reduce Debt

Debt is a bane for most of us and greatly impacts our net worth. When you actively work on eliminating debt from your life and live a life that doesn’t lead to more debt, you will be able to shift towards a net worth mentality. “The easiest way to increase your net worth is to simply eliminate any debt from your balance sheets,” add the authors of the Art of Manliness.

However, you need to realize that paying off your debt isn’t solely reliant on your income. Your savings also play a big role when it comes to eliminating financial debt from your life. “You can always find ways to save a bit more and pay down that nut,” the McKays suggest. They add “I know for some of you, the idea of paying off your debt in a few years seems downright impossible. But it can be done.”

Read How To Ease Your Mind When You’re Drowning In Debt

4. Boost Your Current Income

Taking steps to increase your immediate income is another great way to shift to a net worth mentality. Yes, saving is a crucial part of accumulating wealth, but boosting your income is also crucially, if not equally, important. Although wealth is not heavily dependent on how much money you earn, increasing your income can help to boost your net worth. However, you need to realize that a bigger paycheck doesn’t necessarily mean a better net worth.

Brett and Kate McKay suggest “The fastest and easiest way to increase your income is to ask for a raise from your employer. If it looks like you’ve peaked at your salary level with your current employer, then it’s time to start looking for another job. And if you’re self-employed, consider raising your rates or increasing the number of clients you take on/products you make/services you offer.”

5. Have Multiple Sources Of Income

When struggling from paycheck to paycheck on a monthly basis then it can be definitely hard to develop a net worth mentality. This is why relying on only one source of income, your day job is never a smart financial move.

Look for other ways to bring in more income into your bank account. “Investing, hobbies and other opportunities can provide you a way to take the money you have and leverage it into something even larger,” suggests debt consolidation expert and writer Miranda Marquit. However, you need to be aware of the risks associated with whatever you choose to do.

The McKays add “A side hustle is something you do to earn money during your spare time when you’re not on the clock at work. The sky’s the limit with side hustles. Just take inventory of your talents and figure out if they could be turned into a product or service for which people are willing to pay.”

Read 4 Things To Consider if You Want to Change Careers in Your 40s

6. Start Investing

Once you have paid off your debt, you need to focus on investing to boost your net worth. The key is to focus on the long-term when investing to build wealth. If you’re looking to make fast money, then it will be nothing short of gambling with your existing funds as the risks are simply too high.

Brett McKay writes “I recommend that you focus on index funds for your investments. Index funds provide myriad benefits over traditional stocks and actively managed mutual funds.” The fact is, in the long run, index funds perform better than “actively managed funds.”

Develop The Right Mindset

Most of us tend to believe that the path to financial success is based on our income and a smart monthly budget. However, when we start living from one paycheck to another, we are simply struggling to barely manage our finances instead of growing them. This is why it is crucial that we develop the net worth mentality instead of the budget or paycheck mentality when it comes to improving our personal finances.

“A person with a budget mentality just focuses on increasing their income in order to increase their wealth. A person with a net worth mentality also seeks to boost their income but builds their wealth through saving and investing as well,” explained Brett and Kate McKay, authors of the Art of Manliness.

With the paycheck mentality, you tend to spend your earnings to survive each month. This can lead to a lot of anxiety as you wait for the next paycheck to roll in. However, when you have the mindset to build your net worth, you not only focus on spending less, but also build the habit of growing your wealth each month.

Read 6 Strategies to Help Overcome Financial Stress and Anxiety

Look At The Bigger Picture

“Saving is important,” says financial expert, sales trainer, and author Steve Siebold. However, developing a net worth mentality is not just about saving or earning more. It’s about changing your perspective and the way you treat money. It requires you to shift your focus from the monthly budget to long-term thinking. “Because the long-term future is so fuzzy and amorphous, it can be hard to plan your finances around something so abstract,” add Brett and Kate McKay.

However, if you can make this crucial mental shift, you will feel a lot more financially independent, secure, and confident during your old age.

Read How To Deal With Money Issues In A Relationship

Here is an interesting video that you may find helpful:

Leave a Reply

You must be logged in to post a comment.