Are you tired of living paycheck to paycheck? Do you want to take control of your finances and achieve your financial goals? Let’s explore some practical tips on how to be smart with money and make wise financial choices.

How to be smart with money

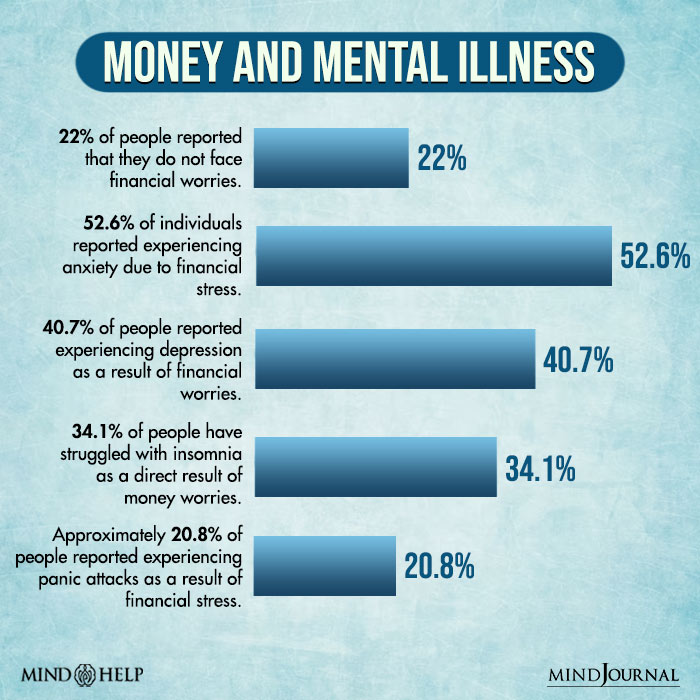

Money can bring freedom and security when managed well, or stress and hardship when mismanaged. Money is an essential aspect of our lives, and managing it efficiently can be a challenge.

Whether you’re struggling to make ends meet or simply looking to increase your financial stability, learning how to become financially smart is crucial. There is no doubt that being smart with how to be smart with your money in your 20s is an essential life skill.

Related: How Saving Money Affects Your Happiness And Psychology

So if you are looking for how to be smart with money, then here are some practical tips to help you get, save, invest and spend money wisely.

1. Start by creating a budget

The first step in being smart with money is to create a budget. A budget is a plan that outlines your income and expenses. By creating a budget, you can track your spending and ensure that you’re not overspending.

To create a budget, start by listing all your income sources, including your salary, investments, and any other sources of income. Then, list all your expenses, including rent/mortgage, utilities, groceries, transportation, and any other expenses.

Once you have listed your income and expenses, calculate your total income and total expenses. If your expenses are more than your income, you’ll need to make some adjustments to your spending.

Look for areas where you can cut back on expenses, such as eating out or entertainment, and redirect that money towards your savings or debt repayment.

2. Build an emergency fund

An emergency fund is a savings account that you can use in the event of an unexpected expense, such as a medical emergency or car repair. It’s important to have an emergency fund because it can help you avoid going into debt or using credit cards to cover unexpected expenses.

To build an emergency fund, set aside a portion of your income each month and deposit it into a separate savings account. Aim to save at least three to six months’ worth of living expenses. This is how to be smart with money. This is how to become financially smart.

3. Pay off debt

Debt can be a significant financial burden, and it’s essential to pay it off as soon as possible. Start by making a list of all your debts, including credit card debt, student loans, and any other loans.

Then, prioritize your debts based on interest rates and pay off the highest interest rate debt first. To pay off your debt faster, you can use either the debt snowball or the debt avalanche method.

With the debt snowball method, you start by paying off the smallest debt first and then move on to the next smallest debt. With the debt avalanche method, you start by paying off the debt with the highest interest rate first and then move on to the next highest interest rate debt.

4. Invest what you can

Once debt is paid off and you have emergency savings built up, you’ll want to start investing some of your income for future goals. Even small amounts invested regularly over time can grow into significant sums.

Choose low cost index funds and ETFs rather than paying high fees for actively managed mutual funds. Real estate can also be a smart investment, particularly rental properties that produce income and build equity.

Determine your investment time horizon and risk tolerance before opening investment accounts. Diversify across different types of investments to reduce volatility.

5. Watch for hidden expenses

Being smart with money requires an awareness of all your expenditures, including commonly overlooked expenses.

For instance, fees for various accounts and subscriptions like credit cards, bank accounts, phone plans, streaming services and memberships can eat into your budget.

Automate bill payments when possible and negotiate lower rates. Check your credit report at least once a year for errors and unauthorized accounts.

Impulse and convenience purchases, especially when dining out, also contribute to leaks in your finances. Track all spending for a month to identify hidden expenses you can reduce or eliminate.

Looking for more tips on how to become financially smart? Read on.

6. Shop smart

Shopping smart means making wise purchasing decisions. Before making a purchase, do your research and compare prices. Look for sales, discounts, and coupons.

Consider buying used or refurbished items instead of new items to save money. When shopping for groceries, make a list and stick to it to avoid impulse purchases.

7. Automate your savings

Automating your savings is a simple and effective way to build your nest egg. By setting up automatic transfers from your checking to your savings account, you can save money without even thinking about it.

You can also automate contributions to your retirement account, such as a 401(k) or IRA, to ensure that you’re saving for the future. This method takes the guesswork out of saving and helps you build your financial security one transfer at a time.

8. Negotiate your bills

Many people don’t realize that they can negotiate their bills, such as their cable, internet, or phone bills. Call your service providers and ask if they can offer you a better rate. You may be surprised at how much you can save just by asking.

If you’re not comfortable negotiating, consider using a service like BillCutterz or Trim, which will negotiate your bills for you.

9. Save for retirement

Saving for retirement is essential, even if retirement seems like a long way off, as it is another great tip on how to become financially smart. The earlier you start saving for retirement, the more time your money has to grow.

Start by contributing to your employer’s retirement plan, such as a 401(k) or 403(b). In case your employer is not offering a retirement plan, you can open an individual retirement account (IRA).

Related: How To Boost Your Net Worth: 6 Ways To Upgrade To A Net Worth Mentality

10. Invest in yourself

Investing in yourself can yield tremendous benefits in the long run. Consider enrolling in courses or workshops that can help you upgrade your skills and advance in your career.

Additionally, prioritize your health by exercising regularly and eating a balanced diet. By investing in yourself, you’ll enhance your earning potential and overall well-being, which will pay off in the long-term.

But wait! We are not done yet. Here are some more tips on how to be smart with your money in your 20s.

11. Live below your means

Embracing a more modest lifestyle, even when you can afford more, is one of the smartest ways to handle your finances. Make a habit of paying yourself first by putting savings into investments before spending leftover funds.

Buy used rather than new when possible.

Shop sales and use coupons.

Cook at home more often instead of dining out.

Resist social pressures to keep up with more expensive trends or consume the latest gadgets.

The less you spend, the more money you can save and invest for the future. Focus on experiences and personal growth rather than material purchases and status symbols. This is a great strategy to learn how to be smart with money.

12. Avoid lifestyle inflation

Lifestyle inflation is the tendency to increase your spending as your income increases. While it’s natural to want to improve your standard of living as your income grows, it’s important to avoid overspending.

Instead of increasing your spending, redirect the extra money towards your savings or debt repayment.

13. Plan for the future

Planning for the future means thinking about your long-term financial goals. Do you want to buy a house, start a business, or travel the world?

Whatever your goals are, it’s important to have a plan in place to achieve them. Set specific goals, create a timeline, and track your progress regularly.

14. Seek professional help

If you’re struggling to manage your finances, don’t be afraid to seek professional help. A financial advisor can provide guidance on budgeting, investing, and retirement planning. They can also help you create a personalized financial plan based on your goals and needs.

Now that we know how to be smart with your money in your 20s, let’s understand we can better track our expenses.

How to track your spending effectively

Knowing about how much you spend is a vital aspect of learning how to be smart with money. Here are some tips for tracking your spending more effectively:

1. Use a budgeting app

There are many great budgeting apps available that can help you track your spending in real time. As you make purchases, enter them into the app so you always know where you stand against your budget.

2. Track with receipts

Keep all your receipts for a month and sort through them periodically to record your spending. At the end of the month, this can give you an accurate snapshot of where all your money went.

3. Get a cash envelope system

Withdraw cash for specific spending categories and only spend from the designated envelopes. When the envelope is empty, you’re done spending in that category for the month. This makes your spending very visual and tangible.

4. Make purchases with a credit card

A credit card makes it easy to track all your purchases in your monthly statement. Review the statement line by line and categorize each expense. Pay the full balance on time to avoid interest.

Related: How To Deal With Money Issues In A Relationship

5. Automate savings goals

Have part of your paycheck deposited directly into a savings or investment account, preferably one that is separate from your daily expenses. Set up automated transfers if possible.

6. Review your spending regularly

Whether weekly, biweekly or monthly, take time to review your budget and spending tracker. Make adjustments as needed and look for ways to reduce unnecessary expenses.

These steps can help you gain more control and visibility over your money. Tracking your spending is a key part of being smart with your finances.

How to reduce unnecessary expenses

Looking for more ways on how to be smart with money? Here are some tips for reducing unnecessary expenses:

1. Cancel unused subscriptions

Make a list of all your recurring monthly subscriptions like streaming services, memberships, apps, etc. Cancel any you rarely or never use to save money.

2. Cut the cable cord

Switch to a cheaper streaming service instead of cable TV to save up to $100 or more per month.

3. Brown bag your lunch

Make lunches at home instead of buying lunch everyday at work to save $200-$400 per month. This is crucial if you want to learn how to be smart with your money in your 20s.

4. Limit online shopping

Only buy things you really need and avoid impulse purchases to reduce spending on unnecessary items.

5. Reduce grocery bill

Make a meal plan, make a list before shopping, buy store brands, and avoid overspending on snacks and drinks. This can save $50-$100 per month.

6. Downsize your phone plan

Compare rates and switch to a cheaper cell phone plan with fewer data, minutes and texts if you don’t need unlimited.

7. Skip the Starbucks

Make coffee at home instead of buying expensive coffee drinks every day. This can save $100s per month.

8. Change insurance policies

Compare rates and switch to a cheaper car, home, and life insurance provider if possible.

9. Cut personal care costs

Get haircuts less often, paint your own nails instead of salon visits, and trim your own pet’s hair if possible.

The key is to identify expenses you can live without, then make changes to reduce or eliminate them from your budget. Every little bit saved can go towards paying down debt, building an emergency fund or investing for the future.

Takeaway

Learning how to be smart with money takes time and effort, but it’s worth it in the long run. By following these tips, you can make smart financial choices that will benefit you now and in the future.

Remember, it’s never too late to start taking control of your finances. Start today and take the first step towards a financially stable future.

Related: Can Money Buy Happiness? The Relationship Between Money And Happiness

Frequently Asked Questions (FAQs):

What is being smart with money?

Being smart with money means making wise financial decisions, such as budgeting, saving, investing, and avoiding unnecessary expenses.

How can I be good with money?

To be good with money, you should create a budget, save for emergencies, pay off debt, invest, and live below your means.

How can I save money smarter?

To save money smarter, automate your savings, negotiate bills, shop smart, avoid lifestyle inflation, and invest in yourself.

Leave a Reply

You must be logged in to post a comment.